02. Time Series Model: Factor Exposure

M4 L2A 13 Time Series Risk Model Factor Exposure V4

Factor Exposure

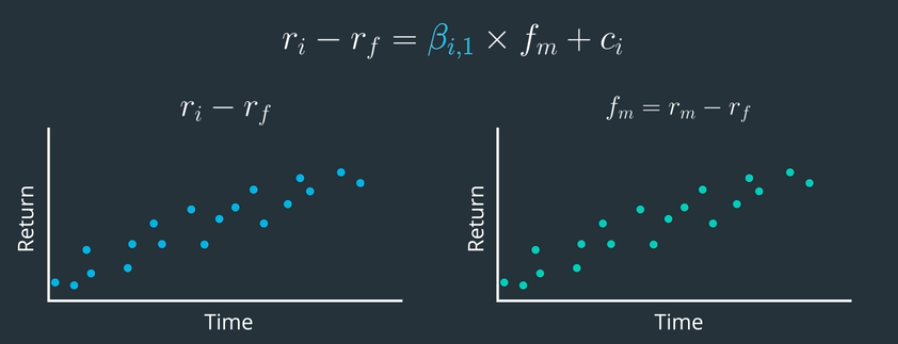

We can use regression to calculate the factor exposures in a time series model. We'll use the asset's excess return as the dependent "y" variable, and the factor return (in this case, market excess return) as the independent "x" variable. The estimated coefficient from the regression is an estimate of the asset's "exposure" to that factor.